Without proper planning, the dream of homeownership can quickly turn into a nightmare, leaving homebuyers financially unprepared for the true cost of owning a home.

While many focus on obvious expenses like the mortgage and down payment, hidden costs — such as maintenance, repairs, and utilities — can quickly add up, straining homeowners’ finances. With nearly half of potential homeowners lacking emergency funds for these unexpected expenses, the financial pressure can become overwhelming.

Understanding both the initial costs and ongoing hidden expenses that impact buyers long after the purchase is crucial for avoiding financial mistakes and ensuring a smooth move.

Key Findings

Article takeaways

- The average annual cost of owning and maintaining a home in the U.S. is $18,000. 47% of American homebuyers lack an emergency fund to cover unexpected homeownership costs.

- Only 21% of Americans feel very prepared for unexpected home ownership costs.

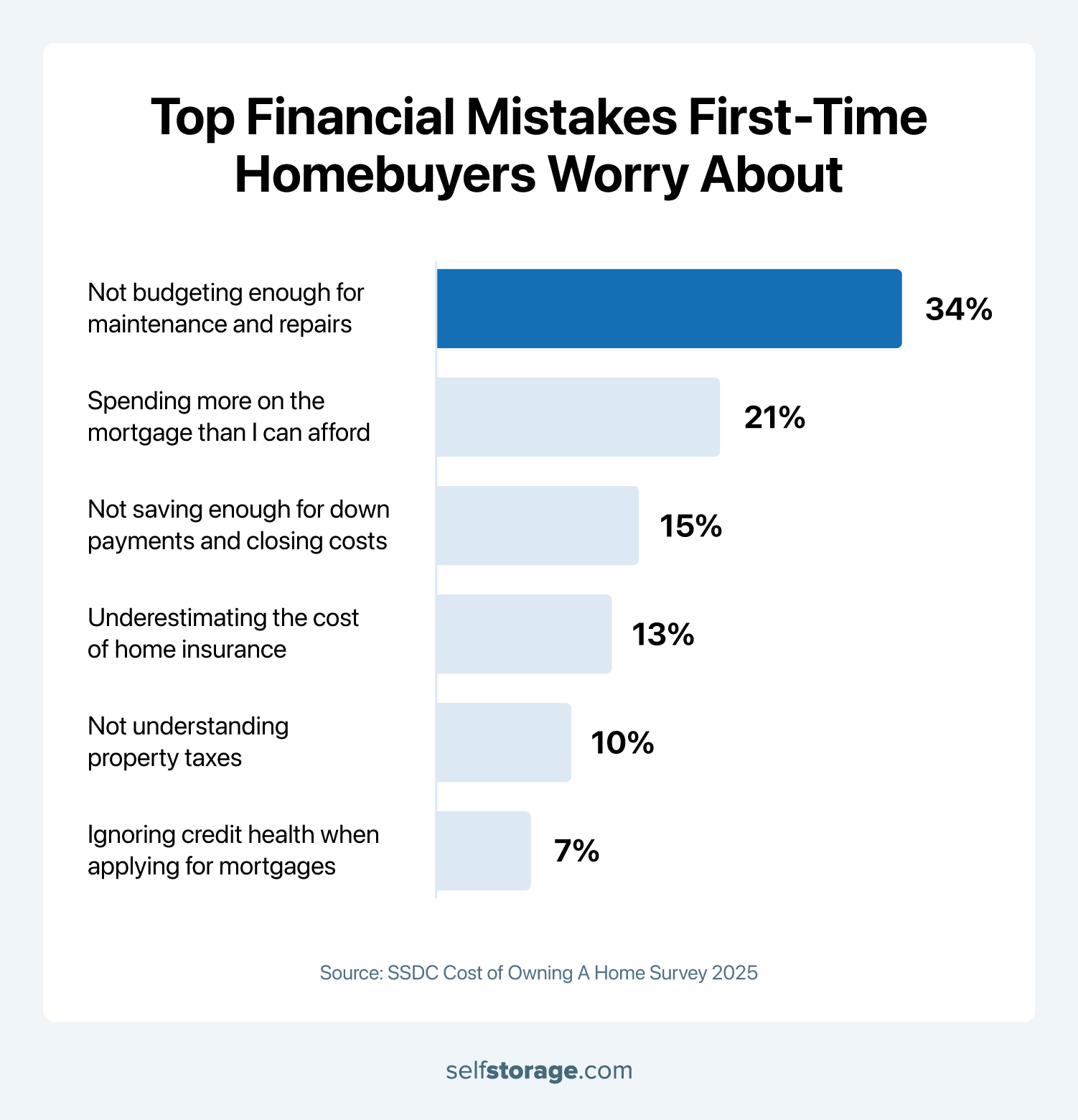

- 34% cite not budgeting enough for maintenance and repair costs as the most concerning homebuyer financial mistake.

Average Cost of Owning a Home

Homeownership costs add up quickly, encompassing both one-time initial costs to buy your home and ongoing expenses like mortgages, home insurance, and utilities. The average cost of owning a home per month depends on your individual financial situation, but annual costs for

owning and maintaining your home average around $18,000.

![Data-driven graphic illustrating the breakdown of homeownership costs across different categories. ]](https://moving.selfstorage.com/wp-content/uploads/2025/03/annual-homeownership-cost-breakdown-2.png)

In addition to expected expenses, there are also hidden costs of owning a home or costs of moving that can catch homeowners off guard. These hidden costs often include:

| One-time costs | Ongoing costs |

|---|---|

| Down payment: 3–20% of home price | Mortgage payments: $2,225 |

| Closing costs: 2–5% of home price | Property taxes: $4,495 |

| Initial home insurance premium: average $2,242 per year | Routine maintenance costs: $3,000 to $12,000 |

| Initial home repairs or renovations: $20,000 to $30,000 | Utilities: $6,888 |

| Short-term storage (two months): $300 to $500 | HOA fees: $3,600 |

| Long-term Storage: $1,440 |

The dollar amounts included in the table reflect average U.S. costs.

Here’s a deeper dive into each cost to help you better understand what they are and how they fit into your home budget.

- Moving costs: Expenses like full-service movers or cleaning fees that aren’t always anticipated;

- Property taxes: Property taxes are annual fees based on your property’s assessed value

- Maintenance and repair costs: These keep a home in good condition, including lawn care, gutter cleaning, HVAC servicing, and fixing plumbing, electrical, or structural issues

- Homeowners Association (HOAs) fees: These are payments homeowners make to an HOA in certain communities for maintaining shared spaces like parks or covering services like garbage collection and street cleaning

- Utilities: Utility costs are recurring expenses for electricity, water, gas, trash collection, and sometimes internet and cable, fluctuating based on usage, home size, and regional rates

- Home insurance: Homeowners insurance covers damage to your home or belongings from incidents like fire, theft, or natural disasters and protects against liability

47% of Americans Don’t Have an Emergency Fund for Home-Related Expenses

As a homeowner, unexpected expenses are inevitable. Yet, nearly half of Americans don’t have a dedicated emergency fund. This can leave homeowners vulnerable when faced with sudden repairs or other home-related costs, potentially leading to financial stress and instability.

It also aligns with how homeowners feel about their ability to handle the hidden costs of homeownership. For instance, 34% of Americans say the biggest financial mistake they fear when buying a home is not budgeting enough for maintenance and repair costs.

You can start saving for an emergency fund by:

- Set a realistic savings target, like $500 or $1000, and gradually increase the target as you adjust to the change in your budget.

- Automate savings with paycheck contributions to reduce the urge to spend money you want to put aside.

- Reduce nonessential expenses by looking for areas such as dining out or subscriptions you can cut back on.

However, building an emergency fund for homeownership is just one part of preparing for unexpected costs. Starting your home journey with a solid financial foundation — by saving on moving costs and other initial expenses — can provide a helpful cushion for those unforeseen expenses down the road.

Only 21% of Americans Feel Very Prepared for Unexpected Homeowner Costs

While a majority of homeowners feel at least somewhat prepared for unexpected homeownership costs, less than a quarter feel very prepared to handle them effectively.

One of the main reasons this number is so small could be that 38% of Americans fail to factor in expenses beyond the home price and mortgage when budgeting for a home purchase. This leaves them unprepared for unexpected ongoing costs of owning a home, like maintenance, repairs, and utilities.

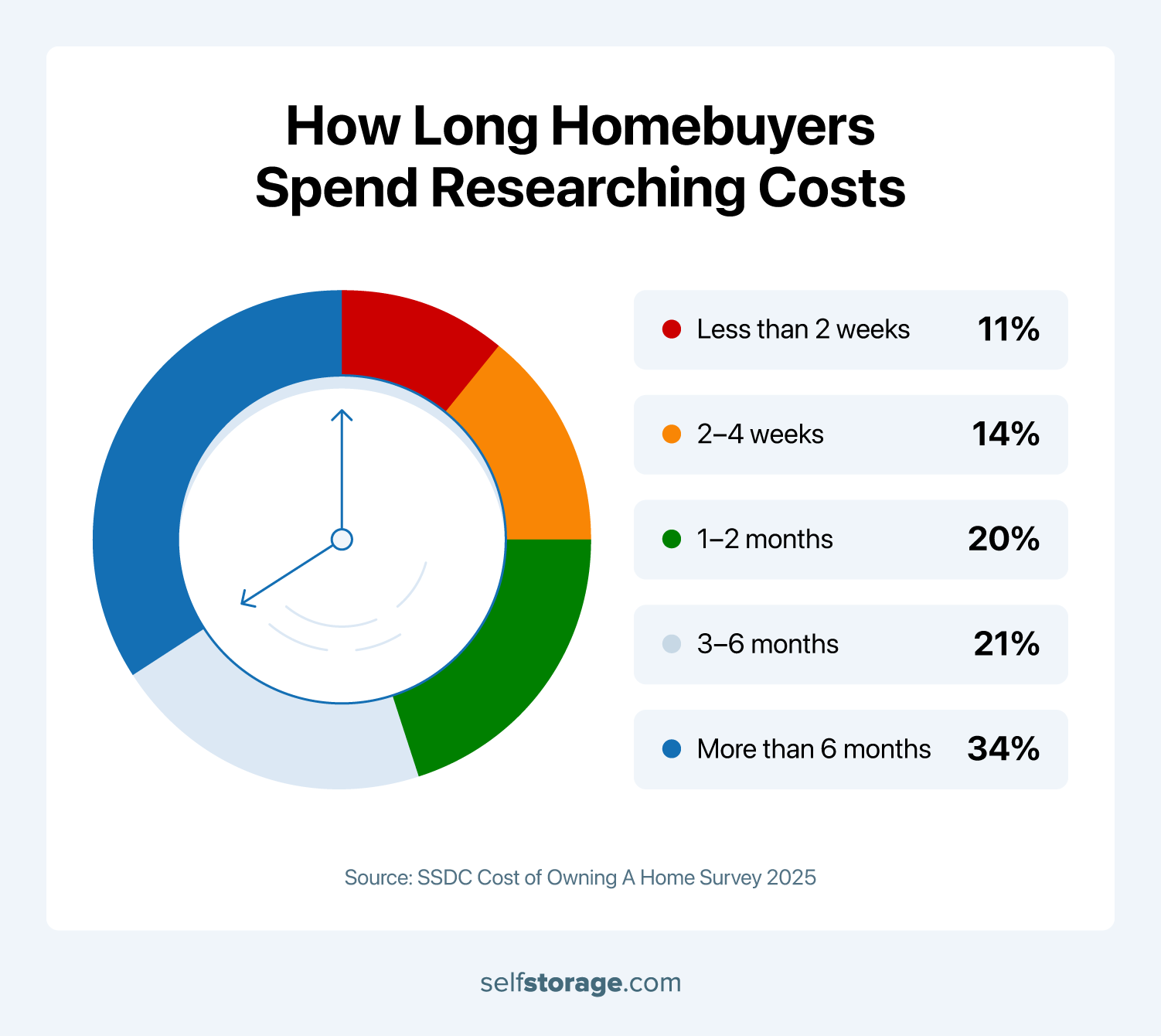

Another contributing factor could be a lack of research on average homeowner costs in general. Understanding the costs associated with your local housing market, like the average home size and price per square foot, helps you plan for unexpected expenses. Despite this, a quarter of Americans spend four weeks or less researching the market before making a purchase decision.

A lack of research leaves many homeowners unaware of the total estimated financial demands of owning a home. Proper planning is key to protecting your finances during a major purchase like buying a home, and without it, homeowners risk facing unexpected financial strain

Simplify Moving And Homebuying Costs With Self Storage

The cost of owning a home isn’t just about paying the mortgage — it’s also about preparing for unexpected costs.

One often-overlooked expense is storage, which becomes essential during the moving process, renovations, downsizing, or unexpected space issues. Planning for hidden costs like maintenance and self-storage helps homeowners stay financially secure and avoid last-minute stress.

SelfStorage makes finding the right storage unit for your needs easy and cost-effective — ensuring you have a flexible solution when you need extra space. Check out our guide on preparing your stuff for long-term storage to learn how to maximize your storage space.

Methodology

The survey of 1,000 adults ages 18 and over who own homes or are looking to buy a home was conducted via SurveyMonkey Audience for SelfStorage.com, LLC on March 3, 2025. Data is unweighted and the margin of error is approximately +/-3% for the overall sample with a 95% confidence level.

Data on the cost of owning a home and hidden expenses was gathered from Bankrate, Investopedia, and Motley Fool Money.

FAQs

M = P. r (1 + r)n. (1 + r)n – 1

Your credit score and other outstanding debts can impact the interest rate that lenders are willing to offer.